Market and government failures #

What is a market failure? #

- A (n unregulated) market failed to generate an efficient outcome

- Not all the costs associated with a private transaction are internalized. For example: pollution.

- Or, certain goods/services will tend to be under-provided by the market because of a lack of incentives. For example: a lighthouse.

- An institution failed in some way: the market.

Typical argument #

- Idealized perfectly competitive economic model of a market would achieve some socially optimal (or Pareto efficient) outcome

- Real world markets sometimes fail to achieve that outcome: “Market failure!”

- Government implements a regulatory solution

Heath’s argument #

- Idealized perfectly competitive economic model of a market would achieve some socially optimal (or Pareto efficient) outcome

- Real world markets sometimes fail to achieve that outcome: “Market failure!”

- Business have a morally responsibility to act in ways that avoid or correct these inefficiencies.

Parallel legal argument #

- An idealized legal process would achieve the perfectly just outcome

- The real world court system sometimes fails to achieve that outcome “Legal failure!”

- Lawyers (or judges…) have a moral responsibility to act in ways that avoid or correct for these failures.

Three kinds of rules #

- Recognition rules: rules about the making of rules, rules that rules have to answer to

- Rules of the game: formal rules of governing “play”

- Rules in the game: informal rules governing “play”

Applying the approach #

- The purpose of market interaction is to generate Pareto-efficient (or positive sum) outcomes.

- Rules that provide for privte ownership and voluntary exchange generally generate Pareto-efficient (or positive sum) outcomes But Sometimes they don’t! Sometimes there are market failures

- When they don’t do what would generate (or a more) efficient outcome A regulatory way to avoid the failure (public intervention, Pigouvian tax, etc). A business-ethical way to avoid the failure (“don’t exploit market failures – correct them”)

Failures, market and government (from business ethics to political ethics) #

Thesis #

- The market will force firms to be ethical enough

- But there are a lot of cases where corps are able to get away with lying and cheating, and be profitable

Corporate power and corporate harm #

- Where does this power come from?

- How are they able to get away with inflicting harm on, e.g. exmployees, consumers, general public?

- Under what conditions would their power to do this be sustainable?

Revised thesis #

- The market will force firms to be ethical enough UNLESS corps are able to insulate themselves from competitive market pressures

How? #

- Government failure

- Example: government privilege concentrates corporate power, which translates into various social harms

Examples? #

- Martin Shkreli, Turing Pharm

- Bailouts for 956 financial corps

- Regulatory capture: regulatory agencies that are created to “protect people from industry” end up serving the established interests in that industry to the detriment of consumers, potential competitors, and everyone else.

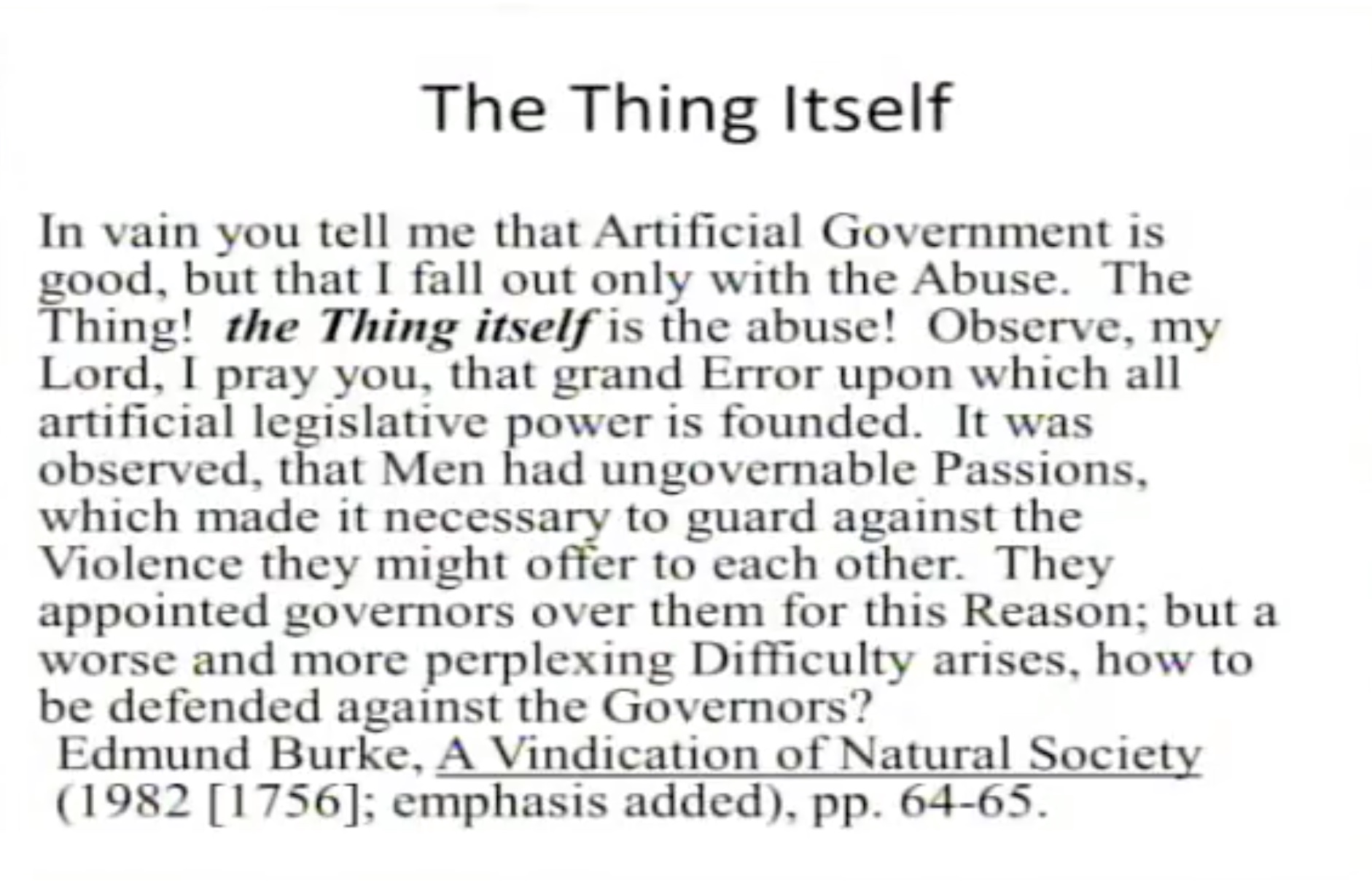

What is a government failure? #

- Government intervention generates an outcome that is less efficient than if they hadn’t intervened

- An institution failed in some way: the government itself

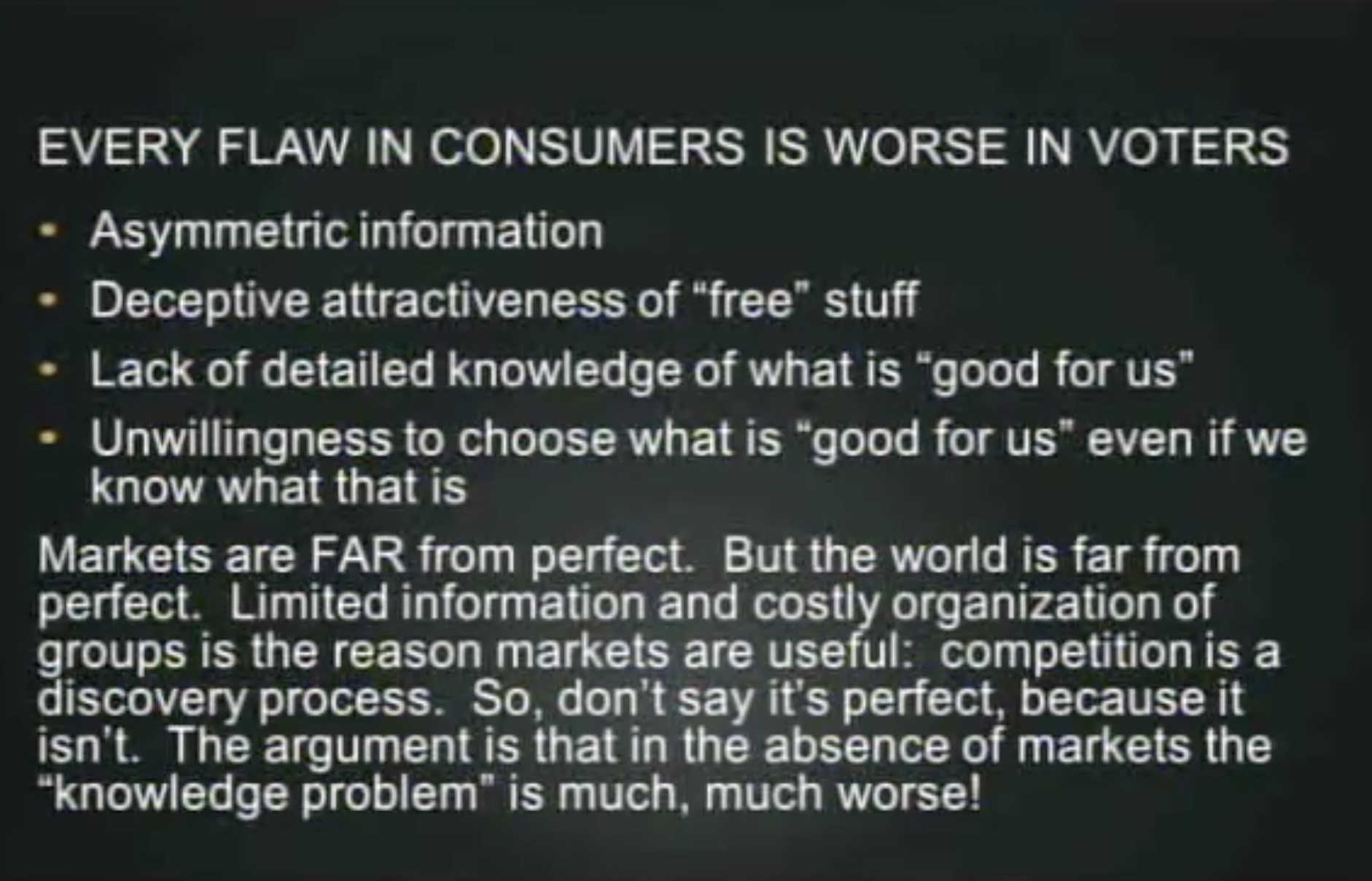

Lesson 1: behavior symmetry #

- Market failure, market actors are self-interested and lack complete information

- Interventionist solution? Are political actors morally and informationally perfect?

- Even if particular markets don’t meet the standard conditions of perfect competition required to ensure social optimality, government intervention doesn’t always make things better. (sometimes it makes things worse)

- Is polotics a Deus Ex Machina, or another tool we have to be careful about how we use?

Lesson 2 #

- A market and government failures approach to business ethics

- General moral rule of thumb: do not seek or distribute/offer rents

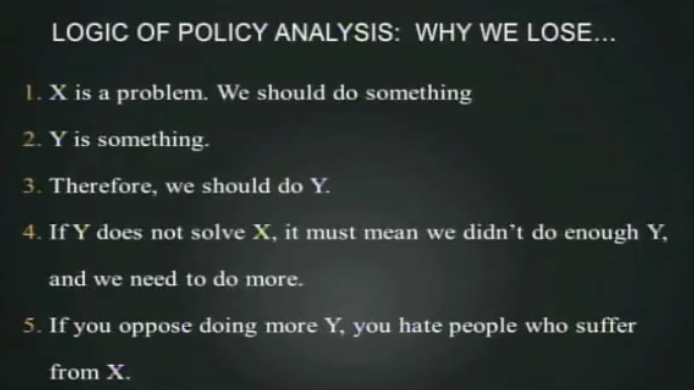

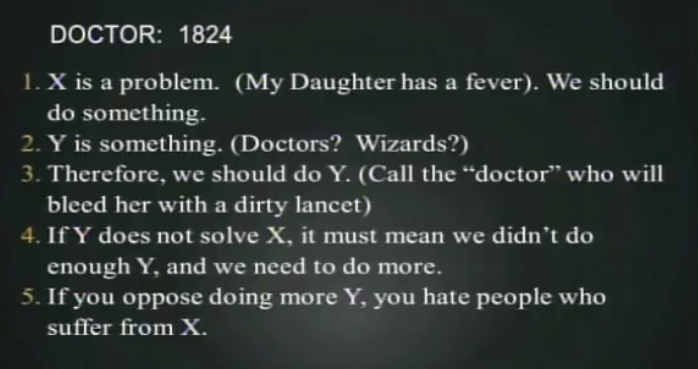

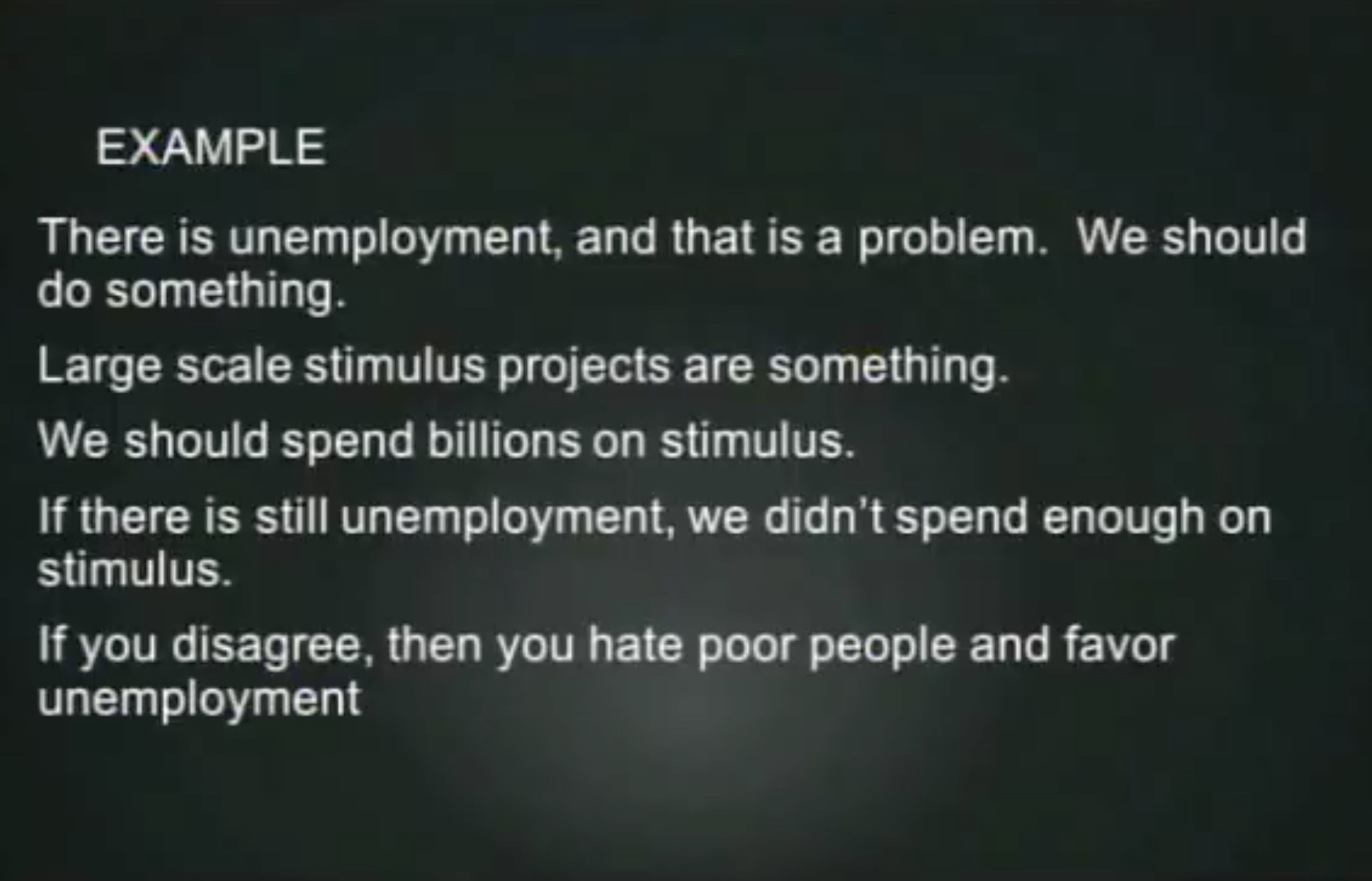

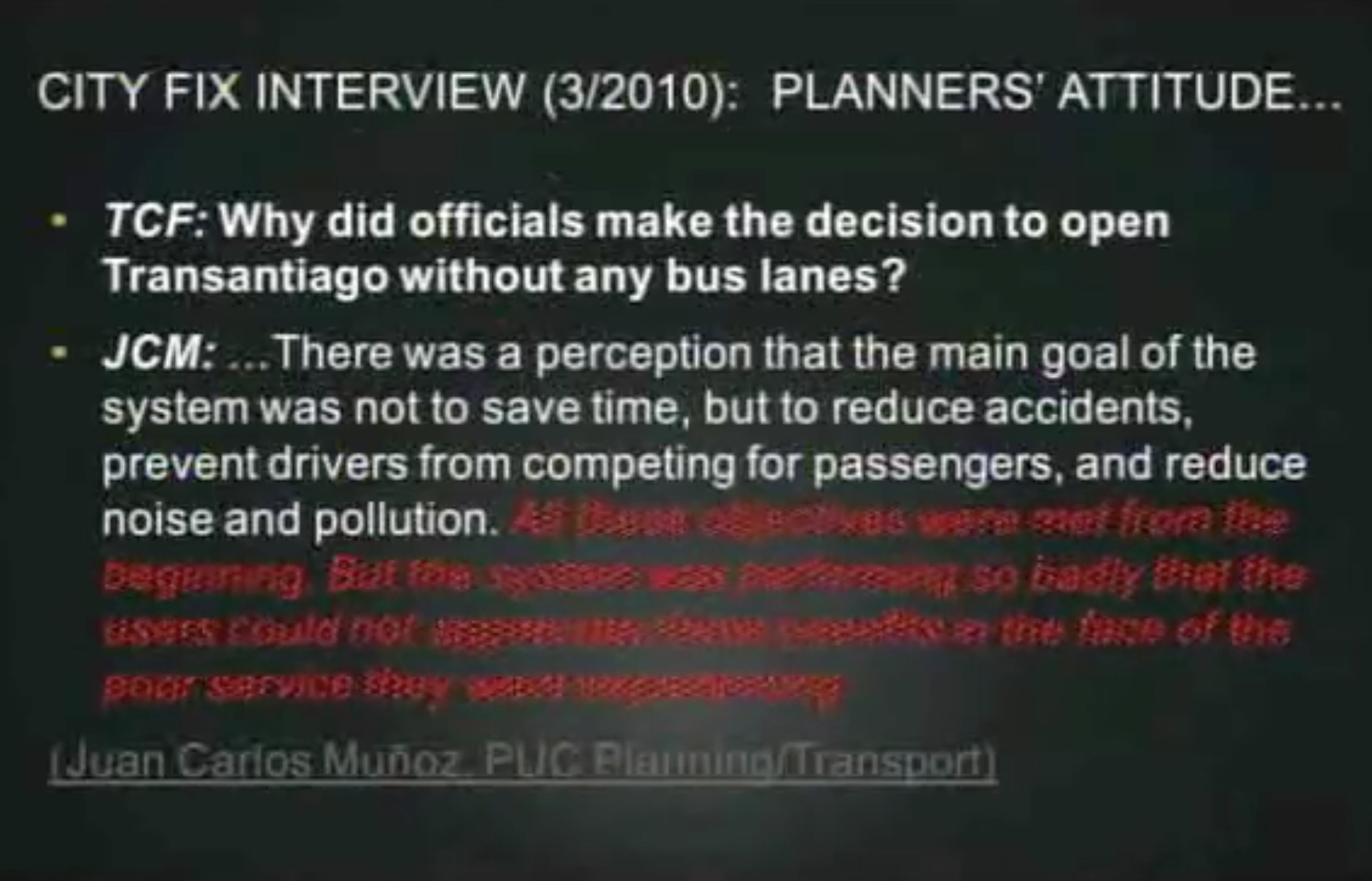

Michael Munger – Market Failure and Sensible Regulation #

The pretty pig contest #

“The first pig is so absolutely ugly that you give the prize to the second pig without even seeing it.”

Step 3 is weak.

The munger test: no unicorns!